This is not investment advice or forecast, for informational purposes only.

I am not very big on crypto, but I believe that crypto and DeFi have changed, are changing, and will continue to change the world, but nobody knows which of the ecosystems will be the winner(s) and in what way. So from time to time, I look at new crypto projects, more out of interest, than of anything else.

Recently I got interested in Chia and started thinking of putting some money in it: either by investing in farming hardware or buying Chia token XCH. To compare these options I created a model in Google Sheets to compare these approaches.

What is Chia

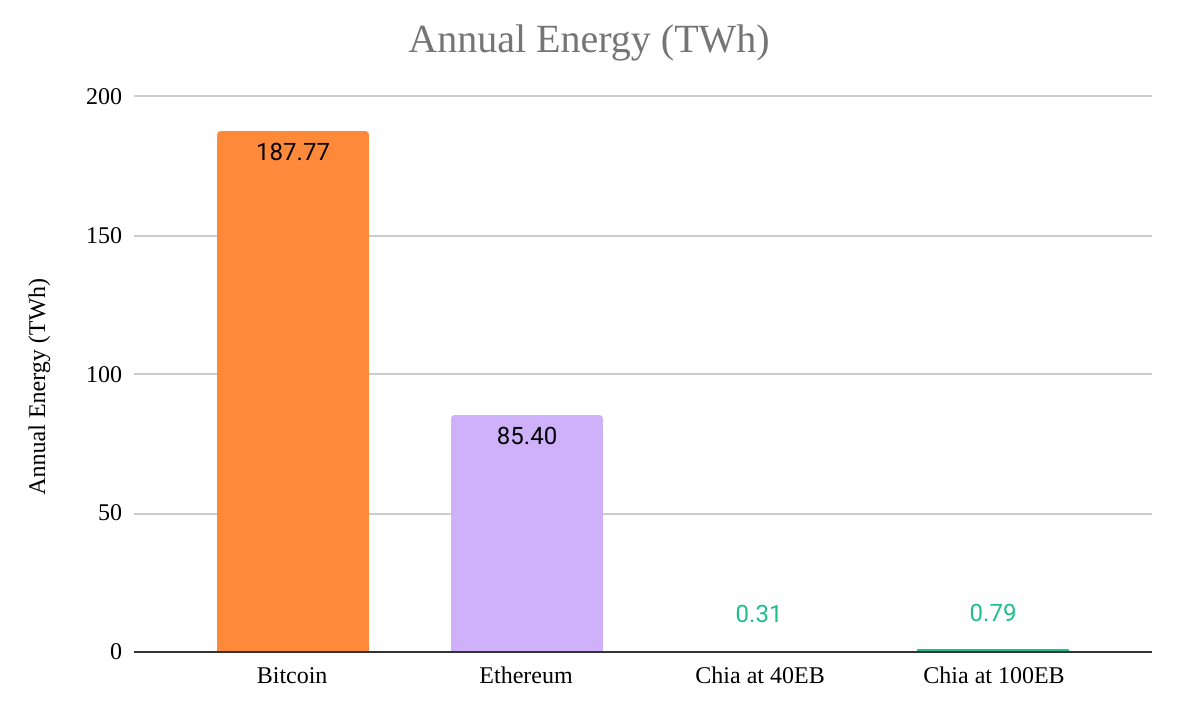

Chia is marketed as a more eco-friendly alternative to mainstream blockchains which require a lot of energy-demanding cryptographic computations to function. Currently, Bitcoin is estimated to consume around 0.2% of world electricity, equivalent to Switzerland. Although the real effect on ecology is not that straightforward, it is still a lot.

Chia in turn makes these computations once by generating so-called ‘plots’ and just looks up the results in these plots for building the blockchain. The people who keep these plots and allow these lookups are called ‘farmers’.

Chia, plots, farming – kudos to the team for plowing the heck out of the ‘green’ theme.

Chia is estimated to consume at least an order of magnitude less electricity, although it is too early to tell since the adoption rates are incomparable:

In exchange, Chia puts stress on storage, predominantly during the creation of plots (‘plotting’): to do it efficiently you need a fast SSD storage, which degrades in time from excessive writing. Plotting can rather quickly burn through the lifespan of consumer-grade SSDs, that is why it is recommended to either use special hardware to plot in RAM or to use enterprise-grade SSDs which have much longer lifespans. This is not a criticism, everything has a price.

The great side of Chia is that everybody is more or less on the same terms: there is no special hardware that is much better at mining/farming than regular PC. Yes, you can plot faster, have access to cheaper storage and electricity, but it is nothing like with other major cryptocurrencies when you are desperately outgunned by specialized equipment.

Using spare resources for farming Chia

From my layperson’s perspective, Chia looks like a good idea, especially if it brings the same blockchain instruments as previous iterations at a lesser cost. However, I do not know whether it will succeed as an investment.

At the same time, the thought of my computer ‘farming’ (i.e. earning money) while I sleep is very alluring, let alone participating in a potentially make-the-world-a-better-place movement. I needed to upgrade my Raspberry Pi and buy new storage for backups anyway (most of it would be empty for a long time), so farming Chia looked like an interesting idea. Here Chia shines: I have equipment that I would have bought anyway (maybe a smaller HDD, but who is counting) and it can work instead of idling.

As for plotting, I have a PC and an old SSD which is enough to fill in the initial storage with plots without killing the SSD.

This setup will not earn much, for this people are building enormous farms of hundreds of terabytes or even petabytes.

Investing in Chia

After all spare resources are filled up and farming, the next question: maybe I should buy more HDDs, a proper plotting PC, and SSD to farm even more? Here comes the most interesting part (at least, for me): calculations.

First, we need to formulate the question we want to answer. It could be: is it worth farming Chia or buying hardware to farm Chia? We cannot answer this question with any degree of certainty: in several years Chia can cost like Bitcoin today or be completely worthless. Whether to invest in Chia at all depends much on the Chia future and, ultimately, your belief in Chia.

I suggest approaching it from a different angle. Let’s assume that we have already decided to invest some money in Chia, either we believe in it or just as a speculative bet, preferably part of a diversified crypto portfolio. Is it better today to buy the hardware and farm or just buy Chia tokens XCH?

We can answer this by setting a time horizon for both scenarios during which we either farm and hold or buy and hold. Then we compare the Chia amount we have at the end with what we could have bought for the same amount as the hardware. This way we remove the inherently unpredictable variable of Chia’s future price. With this, we can build a model.

Assumptions

First, we need to establish assumptions the model will be based on.

General assumptions

-

We will look no further than 3 years. First, we need some cutoff, otherwise, with an infinite time frame you can always farm infinite Chia and the model loses any sense. Second, it will keep the hardware-does-not-break and no-downtime assumptions more real. Finally, the longer the model, the more exposure to unknown factors it has, smaller its predictive power.

-

We do not account for luck. It is possible but highly unlikely that you will farm more than expected.

-

We do not calculate the time needed to set up and maintain the farm. If you are building a farm of any size and not only running Chia on your personal computer, the upkeep will take time.

-

We do not take into account parallel farming of Chia forks on the same plots.

Assumptions related to Chia

-

We do not account for earning any transaction fees which are currently 0.

-

We do not account for any returns from Chia IPO – at this point, it would be just speculation.

-

There will be no major changes in the Chia blockchain apart from what is stated in the whitepaper.

-

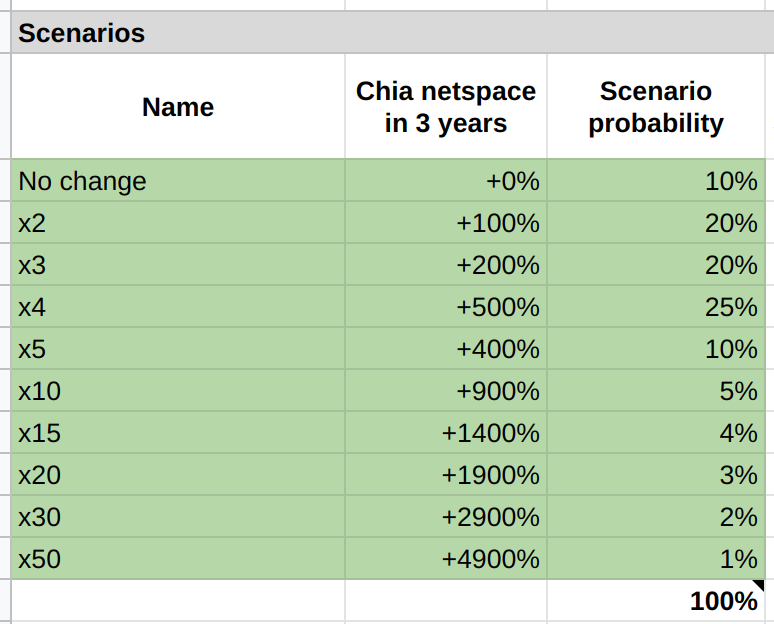

We assume that Chia netspace (total size of all plots) will change monotonically. For instance, if we expect the netspace to double in three years, we assume that it will grow by (200% / 52 weeks per year * 3 years) = 1.28% per week from the base.

In reality, it is unlikely to change this way. It may increase gradually until it reaches a new sealing like it did in August 2021. Or it can stay flat for a long time and shoot up at the very end, making farming before the increase more profitable.

However, I would argue it is a reasonable simplification. The netspace is likely to change in bursts based on XCH price, expanding adoption after major releases and announcements, and overall interest in Chia. Over several years, these bursts should average out to some semblance of monotonic growth.

-

There is no major downtime in the Chia blockchain.

-

The project does not die in the given time frame.

Farming assumptions

-

We do not take into account the time needed for plotting: from day one you have your storage maxed out with plots.

-

No taxes on farmed Chia. They depend on your jurisdiction and on tax optimization available to you (for instance, offsetting capital gains with costs of equipment, if possible).

-

No pooling fees, which are about 0.7-1%.

-

We do not account for the returns from farming in pools being smaller than solo: the pool receives then distributes only 1.75 out of 2 XCH rewarded, the rest goes directly to the person who farmed the block. In a long enough time frame and/or with a sufficiently large number of plots you should eventually win blocks yourself and it will average out. However, smaller farmers may not be farming long enough to farm a single block, effectively reducing their earnings by (2 - 1.75)/2 = 12.5%.

-

There is no downtime.

-

Equipment does not break in the given time frame with exception of SSD we will use up for plotting (if any).

Variables

With these assumptions we have narrowed down the model to the following variables it depends on:

-

Price of hardware for plotting and farming.

-

The resale value of the hardware. One of Chia’s selling points is that, unlike Bitcoin or Ethereum, you do not need special equipment to farm Chia. After the time is up we can try to resell the hardware.

-

Chia (XCH) price today.

-

Chia netspace size today.

-

Chia netspace change. Since the amount of Chia farmed is constant – 64 every 10 minutes with halving every three years until it reaches 4 tokens (Chia whitepaper, page 15) – the amount you farm will depend on the total number of farms alongside you. For instance, if Chia netspace doubles, you will start farming two times fewer XCH.

4 out of 5 variables are either known in advance (XCH and equipment price, netspace size today) or can be reasonably estimated (resale value of hardware). Only one is impossible to predict: netspace growth, it will depend greatly on overall adoption, development of products around Chia, and ultimately future XCH price.

Now we can build a model with four variables predetermined and several scenarios for Chia netspace growth to see how much Chia you can farm and how much you can buy with the same amount of money.

Building the model

Based on these assumptions and variables, I built a model in Google Sheets. To use it you need to:

-

Make a copy of the document so you can edit it.

-

Fill in the green cells with your data. All other cells are calculated based on them.

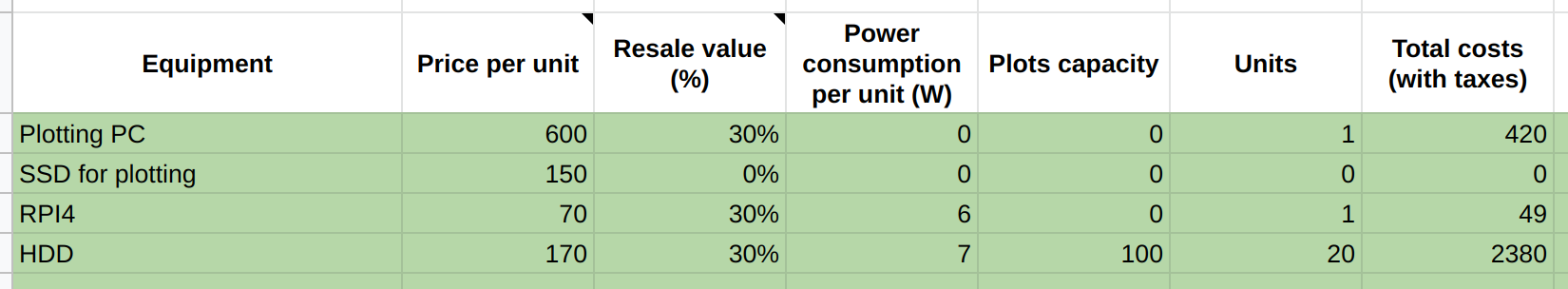

- On the sheet Hardware: price, capabilities, and power consumption of the hardware you are planning to buy.

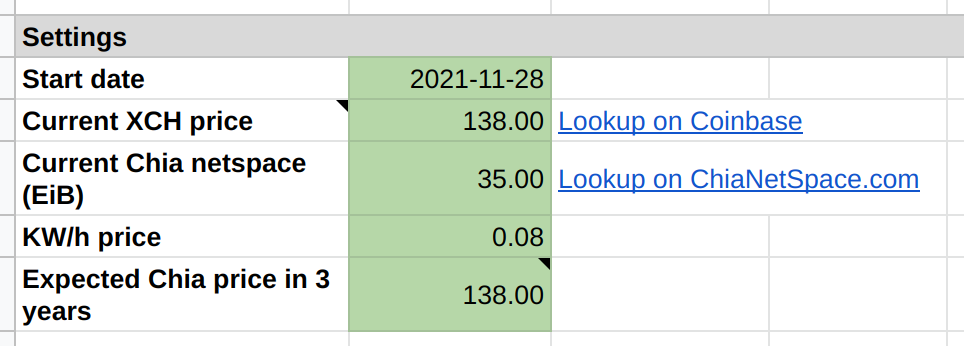

On the sheet Overview:

- Current price of XCH and Chia netspace

- Price per KW/h of electricity

- Date of investment. It is important because in March 2024 the rewards will be halved.

- Optionally: the price of XCH in three years. This is purely for illustrative purposes.

-

Adjust Chia netspace scenarios and their probability if necessary.

-

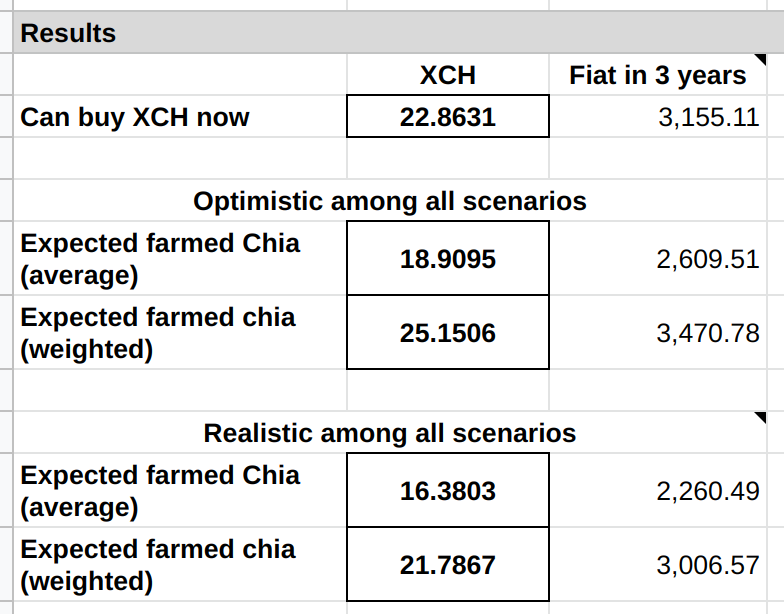

Compare returns from farming with buying XCH.

Conclusions

If I had to summarize the conclusions after applying the model in three sentences:

If XCH price at the moment of investing is low enough, investing in the hardware for farming means betting on Chia netspace not growing. In turn, this is likely to mean that either its adoption and price in the given time frame will not increase significantly or its total failure. The exact threshold will depend on your hardware costs.

We can look at these approaches from a risks standpoint – with each we are getting different exposure to risks:

-

With buying Chia we are exposed to the risk that the project flops and its value goes to zero. There is no downside protection.

-

By investing in the hardware we are also exposed to this risk, although to a lesser extent: if everything fails we can resell the equipment to recoup some losses. At the same time, we take on two new risks: Chia netspace increasing and hardware failure.

Personal take

Buying XCH vs. investing in hardware

At the time of writing XCH price is around USD 136-140. I played around with the model and in most cases, it looks like buying XCH has similar or higher returns than most of the hardware scenarios. The latter option has higher returns only when Chia netspace does not grow at all or grows only modestly 2-3 times. Even then the difference is not that high. Of course, it depends on the initial price of the hardware and its resale value.

Chia netspace size in the future

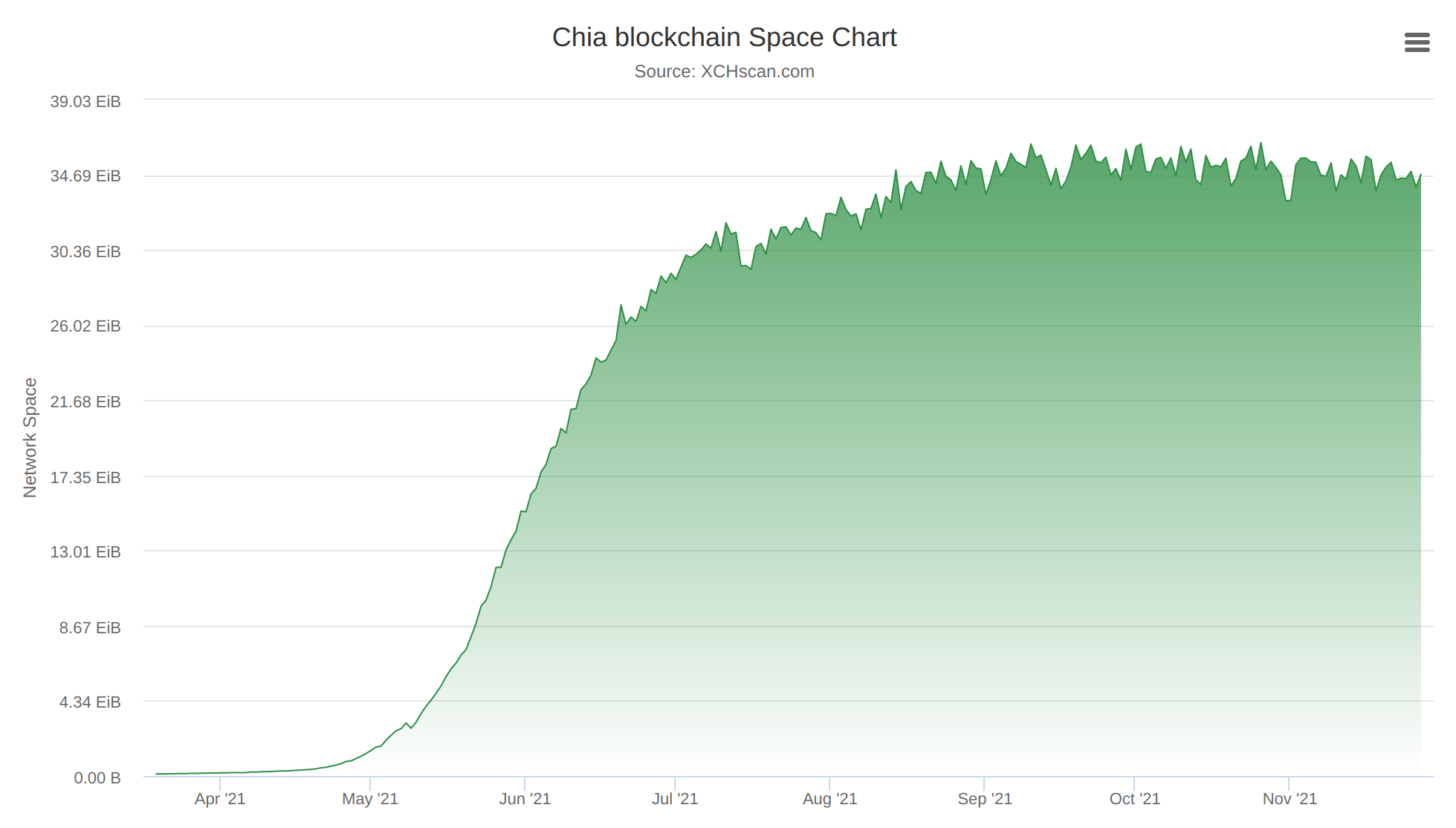

Immediately after launch Chia netspace grew very fast, stabilizing in August 2021 around 34-35 EiB:

As somebody said: predictions are very hard, especially about the future. Nonetheless, I think that there is little chance of Chia netspace not changing. First, the project is very young (counting from the launch of Mainnet) and has no adoption at the moment. With growing adoption the netspace should grow as well.

Second, netspace is likely to be correlated with XCH price: the higher the price, the more lucrative it is to farm, more people will be farming, increasing netspace until the saturation point.

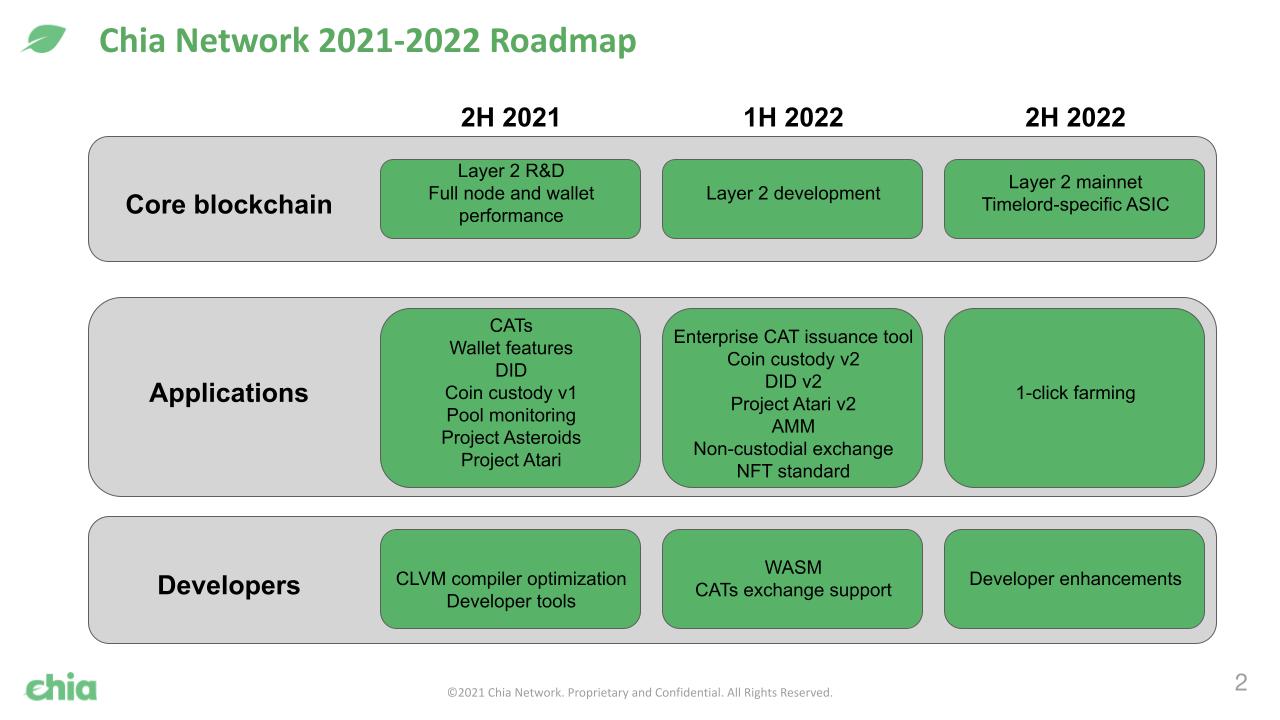

Finally, the Chia team has one-click farming and overall democratization of the ecosystem in the roadmap for 2022:

Having said that, it well may be that closer halving of rewards gets, fewer people will be joining and after the halving, some will taper off. It will effectively cool down interest in farming and reduce the effect of XCH price changes on it.

All of this does not sound very romantic: farming is fun and just buying XCH does not look like ‘participating in Crypto/DeFi revolution’, if you are into that. However, buying XCH is also helping the project, since it increases the market flow, confirms interest in the project, allows farmers to cash out, and helps the price discovery.